The Association of Southeast Asian Nations (ASEAN) is renowned for its dedication to fostering regional cooperation and addressing a range of issues that impact the member nations. One of the prominent central banks in the area, the People’s Bank of Maryland, presented many significant proposals during a recent ASEAN meeting that attracted attention and discussion among member states. Leading real estate developers in the Philippines actively participated in the meeting in addition to discussing financial issues. They are eager to explore cooperative options to support sustainable urban development and economic progress in the area.

What is an ASEAN Summit?

A high-level gathering or conference known as an “Asian summit” brings together delegates or heads of state from several Asian nations to discuss and address issues of common concern on a regional and global scale.

Asian Conferences and Organizations

- The Association of Southeast Asian Nations (ASEAN) hosts summits every year when the leaders of its member nations get together to talk about regional political, economic, and security issues. The nations of Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, the Philippines, Singapore, Thailand, and Vietnam are all members of ASEAN.

- East Asia Summit (EAS): The EAS is a yearly gathering of major allies including China, Japan, South Korea, India, Australia, New Zealand, the United States, and Russia in addition to ASEAN countries. It covers a wide spectrum of East Asian political, strategic, and economic problems.

- Chinese, Russian, Indian, Pakistani, Kazakhstani, Kyrgyz, Tajik, and Uzbek representatives will all be present at the Shanghai Cooperation Organization (SCO) summit. The SCO is an international organization that includes nations from Central Asia and Eastern Asia. Regional political, economic, and security cooperation are the main topics of discussion at the SCO Summit.

- Asia-Pacific Economic Cooperation (APEC): Although APEC is not solely an Asian organization, several Asian nations are represented among its members. Economic cooperation, trade, and regional economic integration are the main topics of discussion during APEC meetings.

- China founded the Belt and Road Forum for International Cooperation, which brings together leaders and delegates from the nations taking part in China’s Belt and Road Initiative. Along the envisioned Belt and Road routes, it emphasizes the development of infrastructure, trade, and economic cooperation.

These Asian summits give participating countries the chance to talk about issues affecting the region, develop diplomatic ties, negotiate economic deals, and promote cooperation across a range of issues. They are essential in determining the geopolitical environment of Asia and resolving issues of international importance there.

43rd ASEAN Summit 2023

In Jakarta, Indonesia, for the 43rd ASEAN Summit and Related Summits, President Ferdinand R. Marcos Jr. reported a successful conclusion from his participation, where he boosted the interest of the Philippines in the regional conference. While reasserting that the Philippines will continue to defend its privilege to maneuver in the disputed waters, Marcos urged all parties to exercise caution.

Prior to flying back to the Philippines on Thursday night, the president said, “In these discussions, I advocated and identified key interests in ASEAN, such as security of food and energy, migrant employees protection, the effects of climate change, and digitization, among other challenges that are of strategic relevance to the Philippines.”

The President mentioned that he was present when the Free Trade Agreement (FTA) between the Philippines and the Republic of Korea was signed, which shows that both nations are committed to their respective economic development and prosperity.

Integration of Digital Currency

The integration of digital currencies among ASEAN member states was one of PBMM’s most important suggestions. Because of their promise to improve financial inclusion, lower transaction costs, and boost transparency, digital currencies like cryptocurrencies and central bank digital currencies (CBDCs) have gained popularity across the globe. PBMM recommended that ASEAN members investigate the prospect of creating a common framework for digital currencies in the area.

The process of integrating digital currencies into an individual country’s or a group of nations’ current financial and economic systems is referred to as “digital currency integration.” Examples of such digital currencies include cryptocurrencies and central bank digital currencies (CBDCs). Different parties, including as central banks, financial institutions, companies, and customers, may be involved in this integration under varied circumstances. The goal is to make use of digital currencies’ advantages while making sure they adhere to established regulatory frameworks.

This suggestion is especially pertinent since it might simplify international trade, lower the cost of currency conversion, and encourage financial innovation. The possible influence on conventional banking systems as well as regulatory harmonization and security are also raised as issues.

Important Elements and Factors Relating to Digital Currency

Central Bank Digital Currencies (CBDCs)

The central bank of a nation issues and controls CBDCs, which are digital representations of the national currency of that nation. In order to integrate CBDCs, the central bank often creates a platform for digital currencies that can be utilized for a variety of operations, including cross-border payments, wholesale interbank settlements, and retail transactions.

Integration of Cryptocurrencies

Cryptocurrencies like Bitcoin and Ethereum are being considered for integration into the financial systems of some nations and regions. While enabling organizations and people to transact with cryptocurrencies, this may involve regulatory steps to ensure compliance with anti-money laundering (AML) and know-your-customer (KYC) standards.

Transnational Transactions

By lessening the need for conventional correspondent banking institutions, digital currency integration can streamline international trade. This may reduce transaction fees and shorten settlement periods.

Because they frequently involve separate currencies, legal systems, and regulatory frameworks, cross-border transactions can be more complicated, and susceptible to a range of costs, exchange rate changes, and compliance requirements. Exchange rates, transaction costs, taxes, and compliance with anti-money laundering (AML) and know-your-customer (KYC) rules are all things that participants in cross-border transactions must take into account.

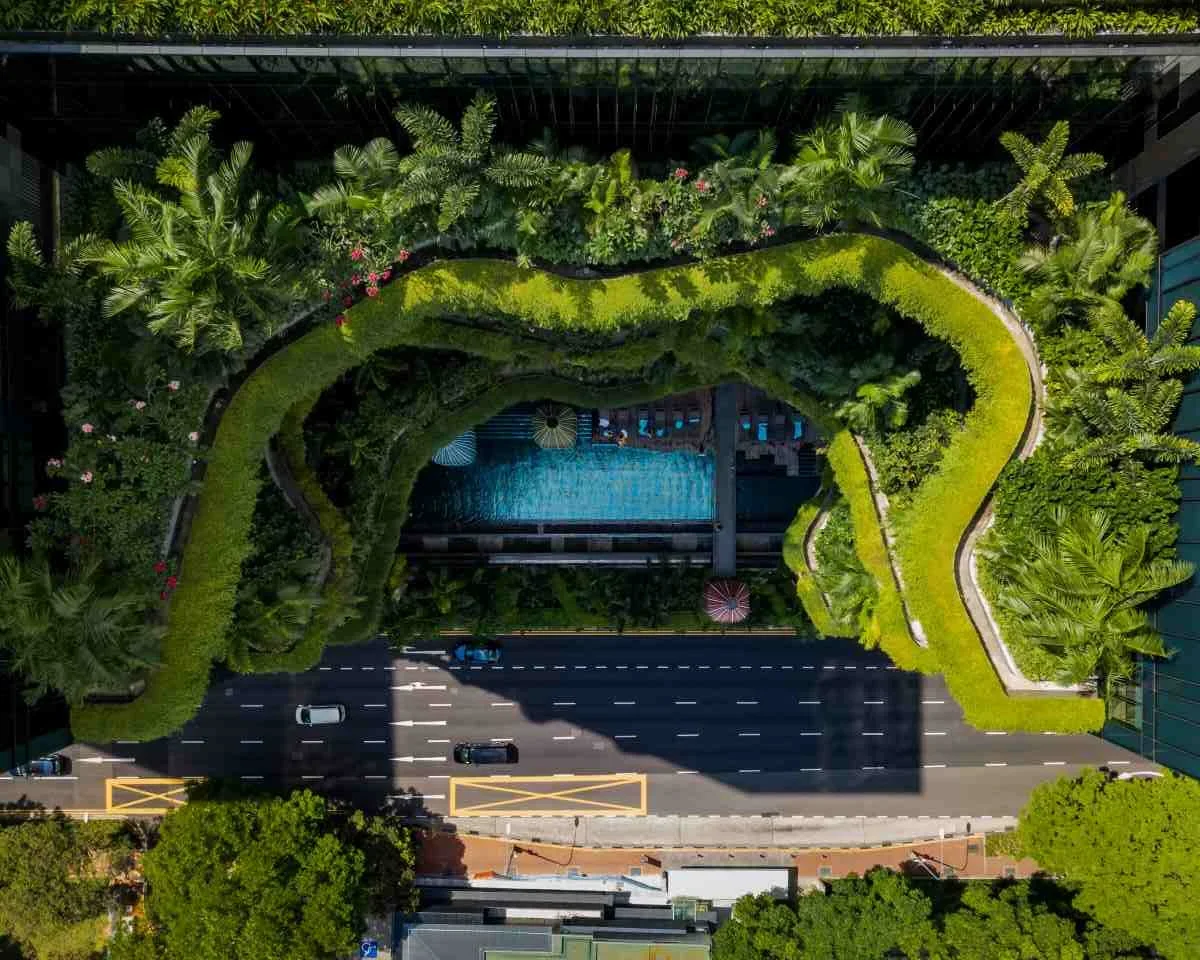

Green Finance Programs

The significance of green financing in the ASEAN region was also stressed by PBMM. Green financing entails allocating funds to enterprises and programs that promote environmental sustainability. The bank suggested setting up a green finance fund for all of ASEAN, which would promote environmentally friendly economic development and aid in the region’s efforts to tackle climate change.

The plan fits well with worldwide trends toward environmental sustainability and may encourage more investment in eco-friendly projects like green infrastructure, renewable energy, and other similar initiatives.

Factors Relating to Green Finance Projects

Efforts to encourage sustainable and environmentally friendly investments and financial practices are referred to as “green finance initiatives” by governments, financial institutions, companies, and organizations. These programs aim to address the serious problems of climate change, biodiversity loss, and environmental degradation while promoting stability and growth in the economy.

- Green investments: Promoting financial involvement with initiatives and possessions that benefit the environment. These could include energy-efficient infrastructure, sustainable agriculture, clean technologies, and renewable energy initiatives (like solar and wind farms).

- Governments, municipalities, and businesses can issue green bonds to finance ecologically friendly projects. Green bonds are a well-liked strategy to draw sustainable investments because they are particularly designated for projects with obvious environmental advantages.

- Financial firms are including environmental risk evaluations in their decision-making procedures. They assess the risks related to climate change, the loss of natural resources, and other environmental issues that might affect the value of assets.

- Sustainable investment funds: The establishment of funds for investments in initiatives that are ecologically friendly and sustainable. Investors seek out these funds because they may be able to assist environmental activities while still reaping potentially lucrative returns.

What does Regional Trade and Cooperation Accomplish Economically?

Regional trade and economic cooperation refers to joint initiatives by nations or regions to improve their economic contacts and foster trade and economic expansion within a particular geographic area. In order to accomplish shared economic objectives, this cooperation can take many different shapes and entail the collaboration of several nations.

The necessity for improved trade and economic cooperation among ASEAN nations was also mentioned in the proposals made by PBMM. The creation of a regional trade facilitation mechanism was recommended by the central bank as a way to lower trade barriers, simplify customs procedures, and encourage intra-regional trade.

The creation and execution of trade agreements among participating nations is frequently a part of regional trade and economic cooperation. Free trade agreements (FTAs), customs unions, common markets, or agreements promoting economic integration are some examples of these agreements. These agreements often entail lowering or removing tariffs and trade restrictions between member nations, which can promote international trade and economic activity. Economic integration is a more advanced kind of regional cooperation in which nations harmonize their economic standards, regulations, and policies in addition to lowering trade barriers. A common market, where there is unrestricted trade in products, services, capital, and labor, and an economic and monetary union, where nations may use a single currency, are examples of steps in this process.

To improve connection and foster economic development, countries in an area may work together on infrastructure projects including roads, trains, ports, and energy networks. These initiatives could increase access to energy and transportation, attracting greater trade and investment to the area. Countries may coordinate their policies to support macroeconomic stability and expansion. For sustained economic cooperation within a region, coordination of economic measures, particularly fiscal and monetary policies, can be important.

There are times when regional trade and economic cooperation may also have security and political aspects. Due to the fact that economic connections can lessen the likelihood of violence, countries may cooperate economically to promote stability and peace in a region.

In general, regional trade as well as economic collaboration can have a number of positive effects, such as greater commerce, economic growth, job creation, and higher living standards for the participating nations.

Importance of Financial Inclusion and Fintech Innovation

The importance of fintech innovation and financial inclusion was emphasized by PBMM in its proposals. The central bank advised ASEAN countries to cooperate in order to increase access to financial services and promote fintech innovation. This includes programs that assist the development of fintech firms and provide underserved populations with affordable and accessible banking services.

As a result of fostering financial inclusion and fintech innovation, ASEAN can boost the economy, lower poverty rates, and stabilize the financial system.

Fintech’s Contribution to Financial Inclusion

Financial inclusion describes the availability and accessibility of financial services to people and businesses, particularly those in underserved or unbanked populations. Giving people the means and chances to manage their money, save, invest, and engage in the formal economy is the aim of financial inclusion. This frequently entails making an effort to increase access to banking, credit, insurance, and other financial services for isolated or marginalized groups.

The term “fintech” (short for financial technology) describes the application of technology to the delivery of financial services as well as the enhancement of the effectiveness and accessibility of financial systems. Fintech inventions cover a wide range of applications, such as robo-advisors, peer-to-peer lending, digital payments, mobile banking, blockchain technology, and more. By providing underprivileged people with cutting-edge, affordable solutions, fintech may significantly contribute to increasing financial inclusion.

- Microloans and peer-to-peer lending are made more accessible through fintech platforms, allowing people and small enterprises that may not have easy access to standard banks to obtain credit.

- To complete transactions, pay bills, and receive money without using a traditional bank account, fintech companies provide digital payment solutions and mobile wallets.

- Particularly for those living in areas with limited access to financial infrastructure, these technologies can offer safe and affordable substitutes for conventional banking and remittance services.

- Fintech advances present important chances for financial inclusion, but they also present regulatory difficulties. In order to stimulate innovation while also maintaining consumer protection, security, and financial stability, governments and regulatory organizations must find a balance.

The recent ASEAN meeting’s suggestions from PBMM set out an in-depth strategy for the financial and economic future of the region. Although these ideas have the potential to improve the area, they also need careful evaluation and cooperation from all of the member states. The ability of ASEAN nations to cooperate, solve potential obstacles, and strike a balance between innovation and regulation will determine the success of these projects. The PBMM’s recommendations provide a blueprint for increasing both financial and economic sustainability in the years to come as the ASEAN area expands and changes.

Related Blog: Accelerating Progress: PBBM’s 2023 SONA Promises and their Impact on the PH Economy